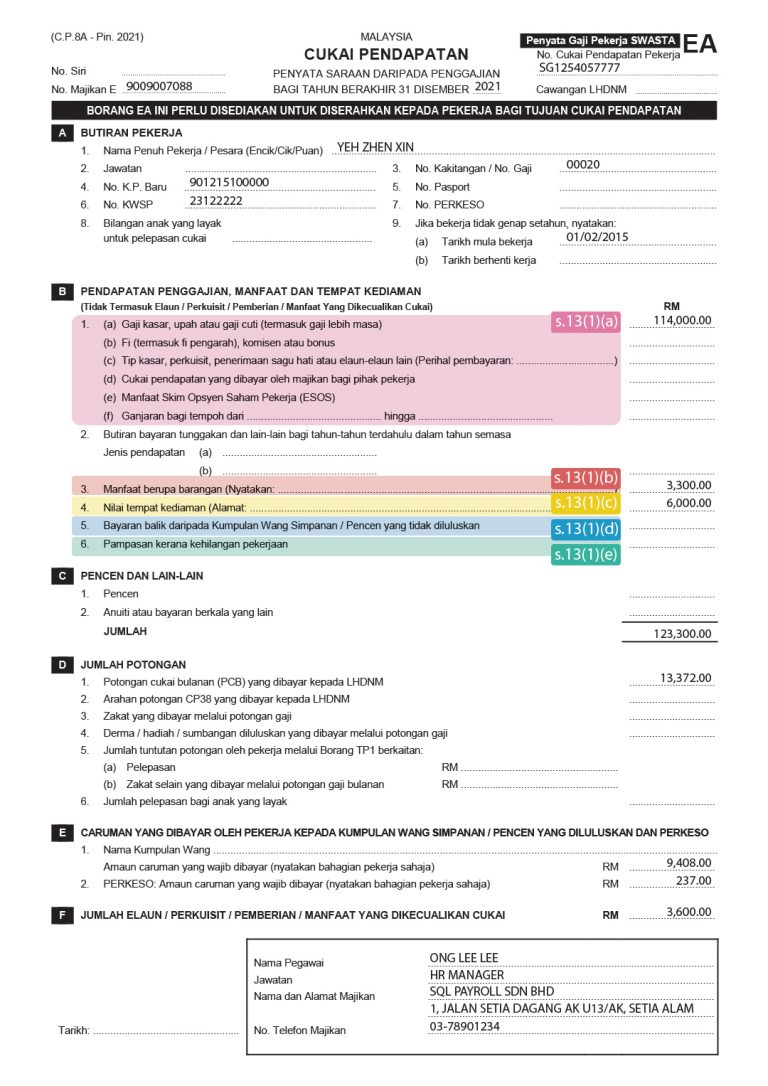

We can also use the EA form to check if we are above the pay grade that requires us to pay taxes. Borang E dan CP8D on or before 31 March 2021.

Ying Group 𝐍𝐨𝐭𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 Lhdn Has Released 2020 Borang E Facebook

Firma Audit di Malaysia yang menawarkan perkhidmatan audit perakaunan percukaian penubuhan syarikat dll khidmat perundingan.

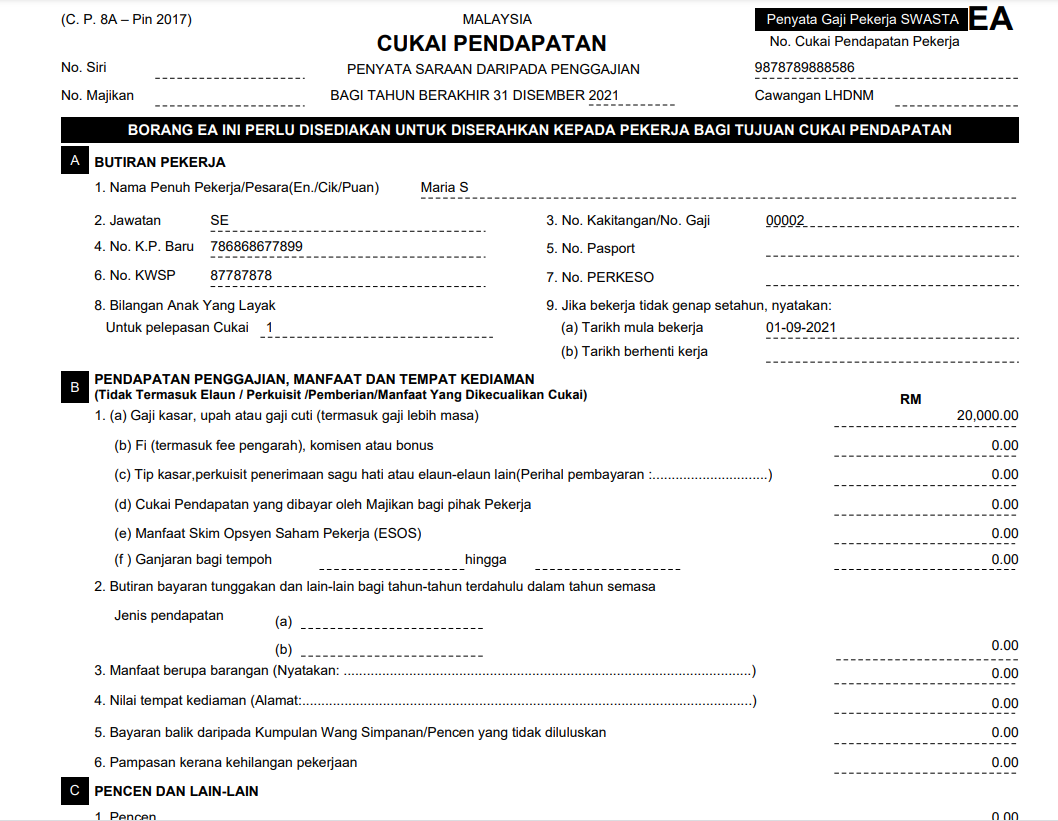

. When declaring our income tax we can use the EA form as a reference to declare the correct amount of annual earnings and deduction. Cara Isi E Filing Lhdn Untuk 2020 2021 Panduan Lengkap. EA forms are provided by the employer company to their employees.

LHDN has released 2020 Borang E EA on 12 January 2021. Ea Form 2021 2020 And E Form Cp8d Guide And Download. According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year.

EA Form in Excel Download. Kegagalan menyedia dan menyerahkan Borang EAEC kepada pekerja pada atau sebelum 28 Februari 2010 adalah menjadi satu kesalahan di bawah perenggan 1201b Akta Cukai Pendapatan 1967. In addition every employer shall for each calendar year prepare and render to.

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih. How to use LHDN E-filing platform to file E form Borang E to LHDN ALL employers Sdn Bhd berhad sole proprietor partnership are mandatory to submit Employer Return Form also known as Borang E E form via e-Filing for the Year of Remuneration 2021 in accordance with subsection 83 1B of the Income Tax Act ITA 1967. A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees.

Failure in submitting Borang E will result in the IRB taking legal action against the companys directors. Section 83 1A Income Tax Act 1967. E 2021 Explanatory Notes and EA EC Guide Notes.

Employers with their own computerised system and many employees are encouraged to prepare CP8D data in the form of txt as per format stated in Part A. Hanya Borang E asal yang dikeluarkan oleh LHDNM. English Version CP8D CP8D-Pin2021 Format.

C Kegagalan menyedia dan menyerahkan Borang EA EC kepada pekerja pada atau sebelum 28 Februari 2019 adalah. Ia adalah untuk memudahkan pembayar cukai menggunakan e-Filing di mana praisi prefill telah dibuat pada borang e-Filing. Borang ea tu adalah penyata gajisaraan setahun untuk pekerja2 swasta.

Borang E yang telah dilengkapkan perlu dikembalikan tidak lewat dari 31 Mac 2010 ke alamat seperti di 5. On and before 3042022. Pastikan dapat borang EA dari majikan.

Aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. Ini adalah senarai pengecualian dan pelepasan rebat cukai LHDN 2021 untuk e-filing 2022 dan rebat yang terkini berdasarkan portal rasmi Lembaga Hasil Dalam negeri LHDN dan juga berdasarkan pengumuman Perdana Menteri Malaysia melalui intipati pembentangan Bajet 2022. Borang ea yearly remuneration statement eaec form 30 4 tu kiranya hari terakhir kena hantar income.

Borang CP8A CP8C EA EC - to all employees on or before 28 February 2021. C Kegagalan menyedia dan menyerahkan Borang EA EC kepada pekerja pada atau sebelum 28 Februari 2022 adalah menjadi satu kesalahan di bawah perenggan 1201b ACP 1967. Ini Adalah Borang Ea Form Untuk Anda Isi Cukai Pendapatan Di Website Efiling Lhdn Myrujukan.

Borang E 2021 PDF Reference Only. EA Form in PDF Download. Apabila pembayar cukai menggunakan e-Filing maklumat tersebut boleh dipinda jika terdapat sebarang perubahan sebelum tandatangan dan hantar borang secara elektronik.

B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2019 adalah menjadi satu kesalahan di bawah perenggan 1201b Akta Cukai Pendapatan 1967 ACP 1967. Borang E EA Data Praisi. As an employer this will be your responsibility to ensure that the rest of your employees get their forms by the month of February every year.

Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 20 2 adalah menjadi satu kesalahan di bawah perenggan 1201b Akta Cukai Pendapatan 1967 ACP 1967. B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2021 adalah menjadi satu kesalahan di bawah perenggan 1201b Akta Cukai Pendapatan 1967 ACP 1967. A reminder on the below deadline-.

Muat Turun Layout Maklumat Praisi. EA forms are crucial for our personal income tax. C Kegagalan menyedia dan menyerahkan Borang EA EC kepada pekerja pada atau sebelum 28 Februari 2021 adalah menjadi satu kesalahan di bawah perenggan 1201b ACP 1967.

Understanding Lhdn Form Ea Form E And Form Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Understanding Lhdn Form Ea Form E And Form Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Understanding Lhdn Form Ea Form E And Form Cp8d

How To Step By Step Income Tax E Filing Guide Imoney

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

Ea Form 2021 2020 And E Form Cp8d Guide And Download

Understanding Lhdn Form Ea Form E And Form Cp8d

Lhdn Borang Ea Ea Form Malaysia Youtube

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Understanding Lhdn Form Ea Form E And Form Cp8d

Malaysia Payroll Compliance How To Generate Ea Form In Deskera People